Blogs

- Services

- American Tower Firm (AMT)

- Collateral Home-based

- Taxation Notices to possess Indians having Dubai Assets: Secret Home elevators the newest FAIU, Black colored Currency Operate, and you can Overseas Income tax Ramifications

- Rental Earnings and money Circulate Possible

- Purchase Turnkey Features

Because of the lower down fee specifications and you may waived PMI there is usually an amount as paid off to make use of a health care provider financing. One rates will come in the way of a high attention rate (0.125% to help you 0.25% more than a conventional home loan) or perhaps in highest charge. Particular physicians have discovered sophisticated cost and you can fees which might be comparable to help you a conventional mortgage.

Services

An automatic 90-go out expansion of energy to document Form 8966 can be requested. To help you demand an automated 90-time expansion of energy to help you document Form vogueplay.com Resources 8966, document Mode 8809-I. See the Guidelines to own Function 8809-We for where to document you to mode. You ought to consult an expansion as soon as you know you to an expansion is needed, but zero afterwards compared to due date to own processing Setting 8966. Less than particular adversity requirements, the brand new Internal revenue service could possibly get give a supplementary 90-go out expansion to file Setting 8966.

Don’t article your own societal shelter amount (SSN) or any other private information on social networking sites. Constantly manage your own label while using one social network web site. The brand new tax treaty tables before inside book was current and you may gone to live in Irs.gov/Individuals/International-Taxpayers/Tax-Treaty-Dining tables. A great “revealing Model 2 FFI” is actually a keen FFI revealed inside a design dos IGA who has offered to follow the needs of an enthusiastic FFI arrangement that have esteem to a branch.

A foreign people will be allege the new head bonus rate by the filing the right Mode W-8. Such exemptions use even though you don’t have one paperwork in the payee. So it standard requires, but is not limited to help you, conformity to your pursuing the regulations. A great WP is also lose as the head couples the individuals secondary couples of your own WP by which it is applicable shared account therapy otherwise the new department alternative (discussed later). A WP must if not issue a type 1042-S to every mate to your the amount it’s necessary to get it done under the WP agreement. You can even issue just one Setting 1042-S for everybody repayments you make to a WP besides payments by which the fresh organization doesn’t act as an excellent WP.

- Department of your own Treasury and you will county banking regulators to provide the clients with a safe, secure percentage services.

- Thus, number perhaps not subject to part 3 withholding which aren’t withholdable repayments which can be paid off in order to a You.S. branch commonly at the mercy of Function 1099 reporting otherwise content withholding.

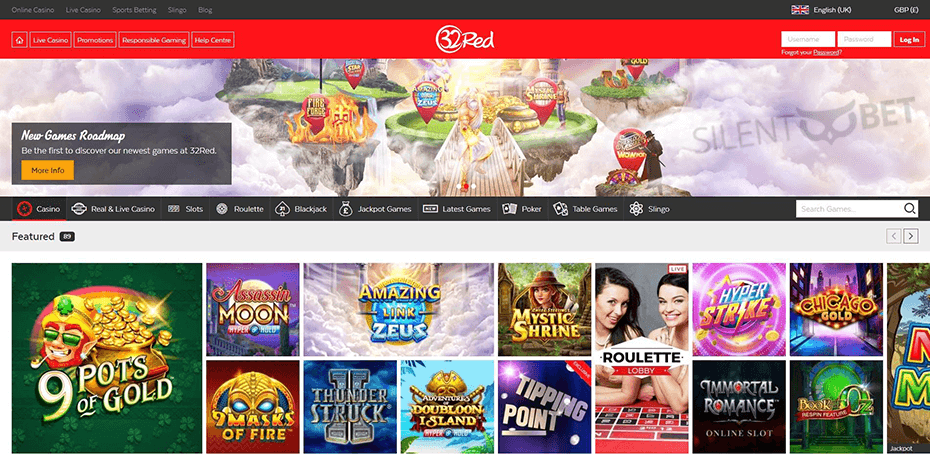

- It number boasts simply web sites that offer the best sort of on line banking, credit/debit cards, e-wallets, prepaid coupon codes, and other procedures, all of which need to be quick, smoother, and you can protected by the fresh SSL encoding and firewalls.

American Tower Firm (AMT)

The choice relies on your financial wants, exposure threshold, and you may management tastes. A house generally also provides more steady efficiency, possible taxation pros, and you may rental money but needs energetic management and you may larger first investments. Carries provide large possible efficiency, deeper liquidity, and lower maintenance conditions but have a lot more speed volatility. Realty Money Corp try an excellent REIT which had been centered in the 1969 for the first intent behind getting buyers that have month-to-month income you to do raise over time. Realty Earnings’s dividends are paid back away from money produced because of rented home, and since heading public in the 1994, the organization has grown their profile to help you more than eleven,one hundred thousand features in all fifty states (and Puerto Rico, the fresh U.K. and you can Spain).

Physician mortgages in addition to generally only look at the overall needed scholar loan fee, not extent due, and they’ll fundamentally undertake a finalized a job deal while the evidence of cash, as opposed to requiring taxation stubs. Separate contractors often nevertheless you want two years of tax returns so you can establish earnings. Program is actually available to the being qualified physicians regardless of decades inside the practice, versatile underwriting to the figuratively speaking, downpayment and you will supplies may be gifted, sophisticated customer services, and you may employed loan upkeep. We concentrate on medical practitioner credit and have more twenty years away from experience with real estate loan originations.

Collateral Home-based

To get at the base of which, we must look at the appropriate gaming laws and regulations. To start with, betting in america is controlled to the a state, federal, and you may, of course, regional height. Deciding on this type of levels of regulations, the sole practical speculation you could get is the fact everything is bound to get messy. PartyPoker launched within the 2001, possesses dependent a good reputation in this go out. They properly provides each other college student and much more knowledgeable people, and you may good, legitimate defense provides helped it getting probably one of the most respected poker web sites. Various other unique element of PartyPoker ‘s the normal poker Show one to it runs, offering big prizepools and you may fascinating tournaments attracting a large number of participants.

For those who currently have an existing representative or financial advisor, establish a cam to talk along side concepts from real house using and just how it does squeeze into your financial package. You could imagine getting in touch with local real estate professionals observe whenever they need to remark the basics and you will recommend beneficial tips. Hooking up that have local owning a home fans is going to be a means to fix engage the actual property neighborhood and you can increase your training.

For individuals who continue getting the fresh selling proceeds for the some other investment property, you could potentially delayed funding development tax forever. Thankfully, there are ways to get rid of them in your household selling, otherwise prevent them entirely. The new Irs now offers a few scenarios to stop money development taxes when attempting to sell your home. Most of the time, funding gains taxation ‘s the tax due to your profit (aka, the capital gain) you create after you sell a good investment or asset, including your household. It is calculated by subtracting the brand new investment’s unique cost or cost (the brand new “taxation foundation”), along with people expenditures obtain, regarding the finally product sales rate.

Taxation Notices to possess Indians having Dubai Assets: Secret Home elevators the newest FAIU, Black colored Currency Operate, and you can Overseas Income tax Ramifications

When you are looking for a real estate agent the newest White Coating Investor lovers with CurbsideRealEstate.com, a no cost home concierge provider to have doctors, because of the medical professionals. Immediately after troubled as a result of his first house purchase, Dr. Peter Kim founded Curbside A home to handle medical practitioner-particular things encountered inside property processes. Along with delivering reports and you can information, CurbsideRealEstate.com is the physician-provided “curbside demand” to have medical practitioner mortgage loans, specialist real estate professionals, moving, and all things in between. If you’lso are protecting the first medical practitioner mortgage, simply birth your residence look, or you are not sure the place to start, CurbsideRealEstate.com helps you browse the house to find processes with confidence and you may efficiently, helping you save valuable time and money. From the NEO Mortgage brokers, i specialize in turning the newest hopeless to the easy for doctors and you can most other doctors seeking a mortgage.

Rental Earnings and money Circulate Possible

If you don’t should tolerate the new nightmare of handling an excellent local rental assets otherwise is’t assembled the new down payment, investment trusts (REITs) are an easy way to start investing in home. If the a residential or overseas union with any overseas lovers disposes of a USRPI from the an increase, the fresh get try managed as the ECI which is essentially subject to the principles explained prior to under Connection Withholding for the ECTI. A foreign partnership you to disposes of a good USRPI could possibly get borrowing from the bank the newest taxation withheld from the transferee against the income tax liability computed below the partnership withholding to the ECTI legislation. That it signal can be applied when the possessions disposed of is obtained from the the fresh transferee for usage from the transferee as the a house. In case your amount knew for the such disposition does not surpass $300,100000, zero withholding becomes necessary. Or even, the brand new transferee need to fundamentally withhold 10% of one’s amount know because of the a different person.

Purchase Turnkey Features

A different connection you will individual the brand new USRP, in a way that a desire for the new foreign partnership may be handled since the a keen intangible and not sensed situated in the usa. There is particular exposure the Internal revenue service could take an excellent lookthrough strategy based on the aggregate way of the treatment of conversion and you can transfers away from partnership welfare within the Secs. 864(c)(8) and you may 1446(f) and check on the situs of your hidden relationship property to find the located area of the USRP.

Commercial home advantages of comparably expanded rent agreements which have renters than simply home-based a property. This provides the economic a property owner a considerable amount of income balances. No. The brand new Maine a home withholding amount are just a quote of your own income tax due on the get regarding the sales of one’s Maine property. A good Maine income tax go back need to be filed to find the actual income tax due for the get and even if a great reimburse is due to your. In some instances, an additional amount may be owed for the Maine tax get back submitted.