You can then use your time and resources to make strategic decisions with the information you’ve gathered from these key reports. Ultimately, understanding and executing the accounting cycle properly empowers you to steer your business toward greater financial stability. A business starts its accounting cycle by identifying and gathering details about the transactions made during the accounting period. Transactions include expenses, asset acquisition, borrowing, debt payments, debts acquired and sales revenues. In the digital age, accounting software plays a crucial role in streamlining the accounting cycle.

Step 8: Closing the Books

- Adjusting entries are prepared as an application of the accrual concept of accounting.

- Book review calls or send messages to get prompt answers to your questions so your financial health is never a mystery.

- The general ledger is a central database that stores the complete record of your accounts and all transactions recorded in those accounts.

- The framework offers bookkeepers and accountants the chance to verify the recorded transactions for uniformity and accuracy, both of which are critical compliance parameters.

- The process of closing temporary accounts includes recording closing entries.

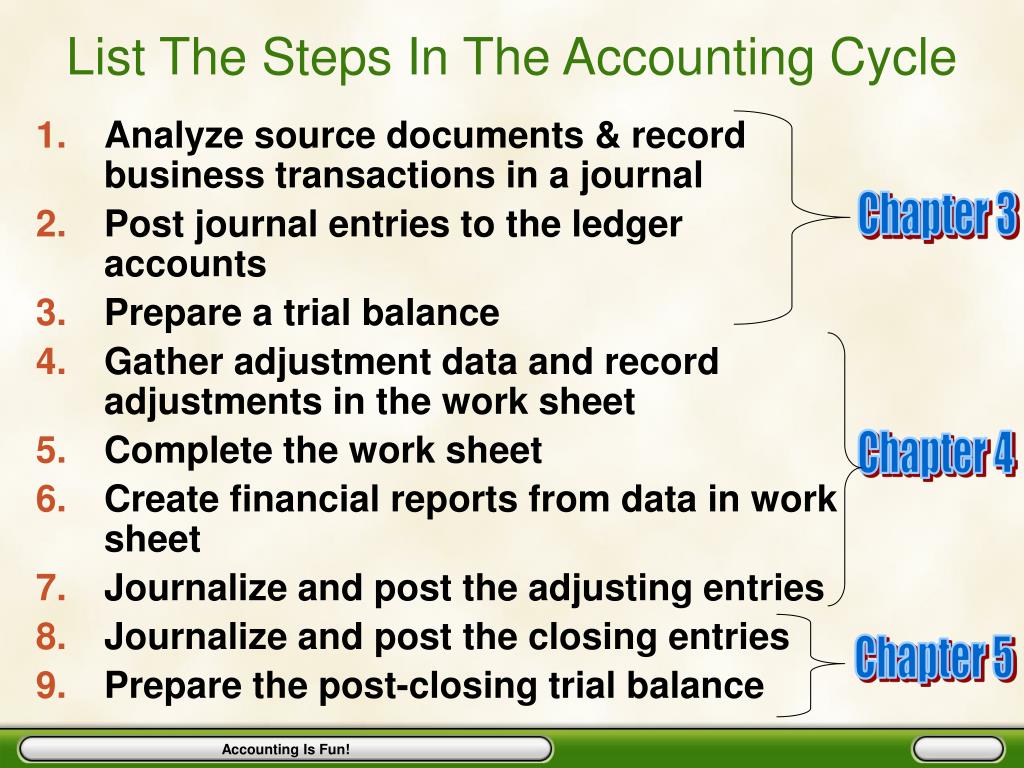

- The accounting cycle, also commonly referred to as accounting process, is a series of procedures in the collection, processing, and communication of financial information.

Then, the documents are forwarded to the finance department for payment. The purchasing cycle starts when different departments, such as the warehouse or the production department, assess when supplies need replenishing. The purchase requisition (PR) is used internally within the company to maintain good internal control systems. During the month of January, Haram’s Company process the following transactions. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Step 7: Create Financial Statements

But if you use accounting software, you won’t need to prepare the trial balance manually. Remember that you don’t have to implement the accounting cycle as-is. You can modify it to fit your company’s business model and accounting processes. With that foundation set, let’s talk about the eight accounting cycle steps in detail. The accounting cycle includes eight steps required to record transactions during an accounting period. In this guide, I explain the steps in the accounting cycle in detail, with examples.

Spend more time growing your business

If the total credit and debit balances don’t match, you need to figure out what’s missing, record those transactions and post these adjusting entries to the general ledger. Is keeping up with the accounting cycle taking up too much of your time? With Bench, you get access to your own expert bookkeeper to collaborate with as you grow your business. Our secure bank connections automatically import all of your transactions for up-to-date financial reporting without lifting a finger. Book review calls or send messages to get prompt answers to your questions so your financial health is never a mystery.

Analyze the worksheet to identify errors.

If you have debits and credits that don’t balance, you have to review the entries and adjust accordingly. Bookkeeping can be a daunting task, even for the most seasoned business owners. But easy-to-use tools can help you manage your small business’s internal accounting cycle to set you up for success so you can continue to do what you love. Making two entries for each transaction means you can compare them later.

Calculate the Adjusted Trial Balance

Adjusting entries are recorded as journal entries, and then posted to the relevant ledger accounts. Once all adjusting entries are completed, an adjusted trial balance is prepared to verify that the total debits still equal the total credits. Subsequently, financial statements are prepared using the adjusted trial balance information. After the unadjusted trial balance has been calculated, the worksheet can be analyzed. Worksheets allow bookkeepers to identify adjusting entries so that the accounts are balanced. This step is also where bookkeepers will ensure that debits and credits are equal.

In the first step of the accounting cycle, you’ll gather records of your business transactions—receipts, invoices, bank statements, things like that—for the current accounting period. These records are raw financial information that needs to be entered into your accounting system to be translated into something useful. Regardless, most bookkeepers will have an awareness of the company’s financial position from day to day. Overall, determining the amount of time for each accounting cycle is important because it sets specific dates for opening and closing.

The general ledger (GL) is a master record of all transactions categorized into specific categories such as cost of goods sold (COGS), accounts payable, accounts receivable, cash, and more. The accounting cycle is important because it gives companies a set of well-planned steps to organize the bookkeeping process to avoid falling into the pitfalls of poor accounting practices. An example of an adjustment is a salary or bill paid later in the accounting period. Because it was recorded as accounts payable when the cost originally occurred, it requires an adjustment to remove the charge. Before you create your financial statements, you need to make adjustments to account for any corrections for accruals or deferrals. Bookkeepers or accountants are often responsible for recording these transactions during the accounting cycle.

The purpose of this step is to ensure that the total credit balance and total debit balance are equal. This stage can catch a lot of mistakes if those numbers do not match up. After the need is identified, the requesting department creates a purchase requisition, which bookkeeping for your business must be approved by authorized personnel. The requisition is then forwarded to relevant departments such as purchasing, accounting, receiving, and kept as a record by the requesting department. Each one of them relates to an accounting transaction that has taken place.

That being said, accrual accounting offers a more accurate picture of the financial state of any given business, which is why in some cases, companies are obligated by law to use this method. However, you also need to capture expenses, which you can do by integrating your accounting software with your company’s bank account so that every payment will be charged automatically. Accruals make sure that the financial statements you’re preparing now take those future payments and expenses into account. The ledger is a large, numbered list showing all your company’s transactions and how they affect each of your business’s individual accounts.